Vision

• To be the most profitable Spanish fund specializing in the acquisition and management of companies in special situations.

• To provide added value in the process of restructuring and reorganizing companies within a short period of time.

• To connect and associate Maecenas with Positive Corporate Reputation.

Mission

• To select the best companies in special situations.

• To implement processes and actions from an ethical business perspective.

• To ensure the best turnaround strategies.

• To manage companies in a way that maximizes their value.

• To divest with capital gains that ensure significant returns for our investors.

“The Maecenas team's direct involvement in the turnaround of a company is the main tool for the Value Generation.”

The Maecenas team draws on its experience and track record of success, coupled with a sound and proven working methodology, to boost value generation in investee companies.

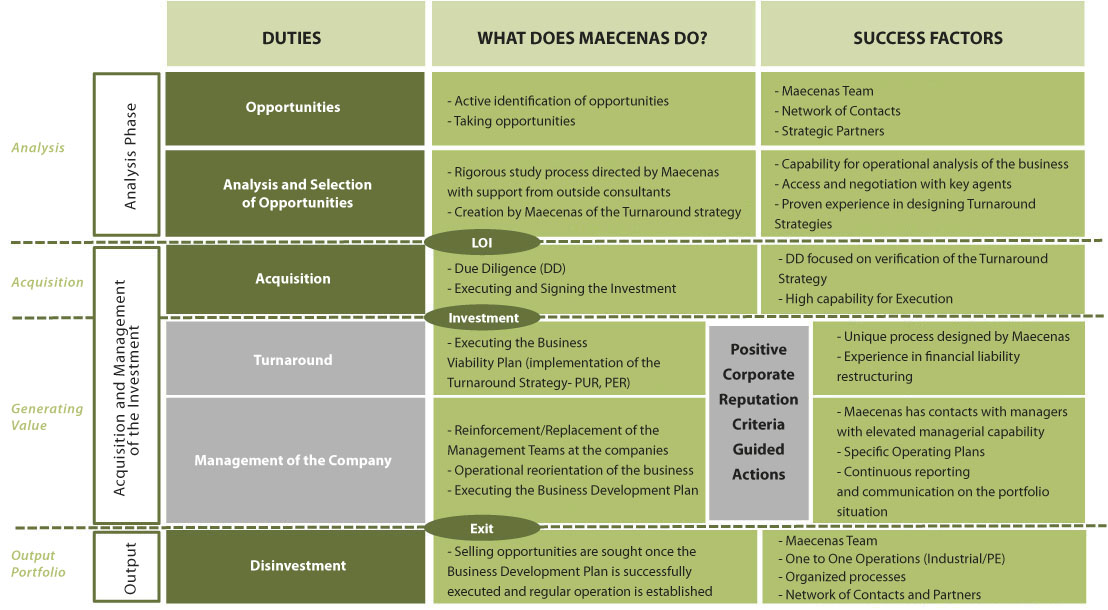

To that end, it uses two fundamental operational levers:

• Implementation of the Turnaround Strategy or restructuring during the first phase of the investment.

• Implementation of the Management Strategy in the maturation phase of the investment with previously selected management teams to complement those already in place in the acquired companies.

Maecenas' differentiation rests on its Pillars for Generating Value:

Our main Pillars:

They allow the management team to maximize return in the different phases of the Investment Cycle:

Maecenas takes a broad tripartite approach:

PHASE 1-Turnaround

During the first year of each investment, the greatest value will be generated by implementing the turnaround strategy (from 6 months to 1 year) in the company.

PHASE 2- Management

From that moment on, value will be generated by guiding and supervising the management team of each investee company (to be strengthened or replaced as needed). In this phase the goal is operational consolidation and financial reorganization.

It is estimated to take 2-3 years from the end of the Turnaround phase.

PHASE 3- Exit

Once the phase 2 objective is achieved, the divestment stage begins, selling off to trade buyers (national/international) and/or private equity funds (national/ international), and generating high returns due to the improved positioning of the investee companies./p>